On July 18, President Trump signed the “Guiding and Establishing National Innovation for U.S. Stablecoins Act” (“GENIUS Act”),[i] which establishes a federal framework for payment stablecoins. This landmark act defines what qualifies as a stablecoin, limits who may issue them and imposes strict prudential standards (including one-to-one reserve backing in cash or Treasuries and timely redemption obligations). A federal licensing regime, overseen by the Federal Reserve, the U.S. Department of the Treasury’s Office of the Comptroller of the Currency (OCC) and other federal agencies will bring stablecoin issuers under bank-like supervision, with coordinated oversight for state-regulated issuers. The act also requires certain disclosures and other consumer protections and mandates anti-money laundering controls.

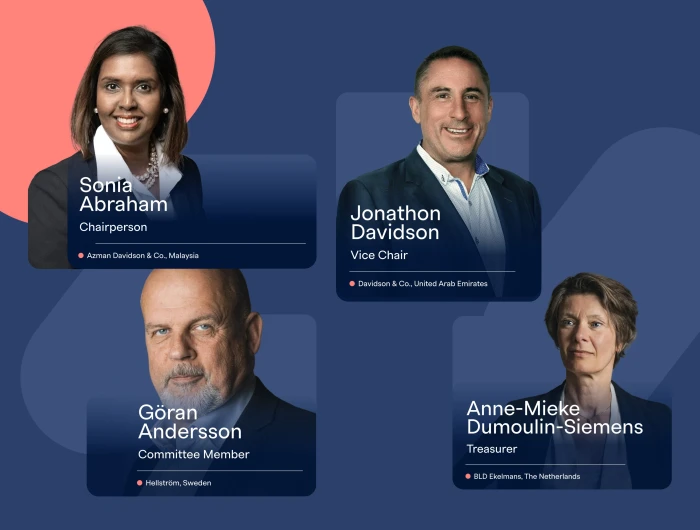

This update by John F. Guild, partner of Bell Nunnally, in Dallas, Texas, analyzes the GENIUS Act’s key provisions and practical implications for issuers, custodians, exchanges and institutional users.

Read the full article here.